Lawsuit Challenges Trump Tariffs, Could Impact Stock Market

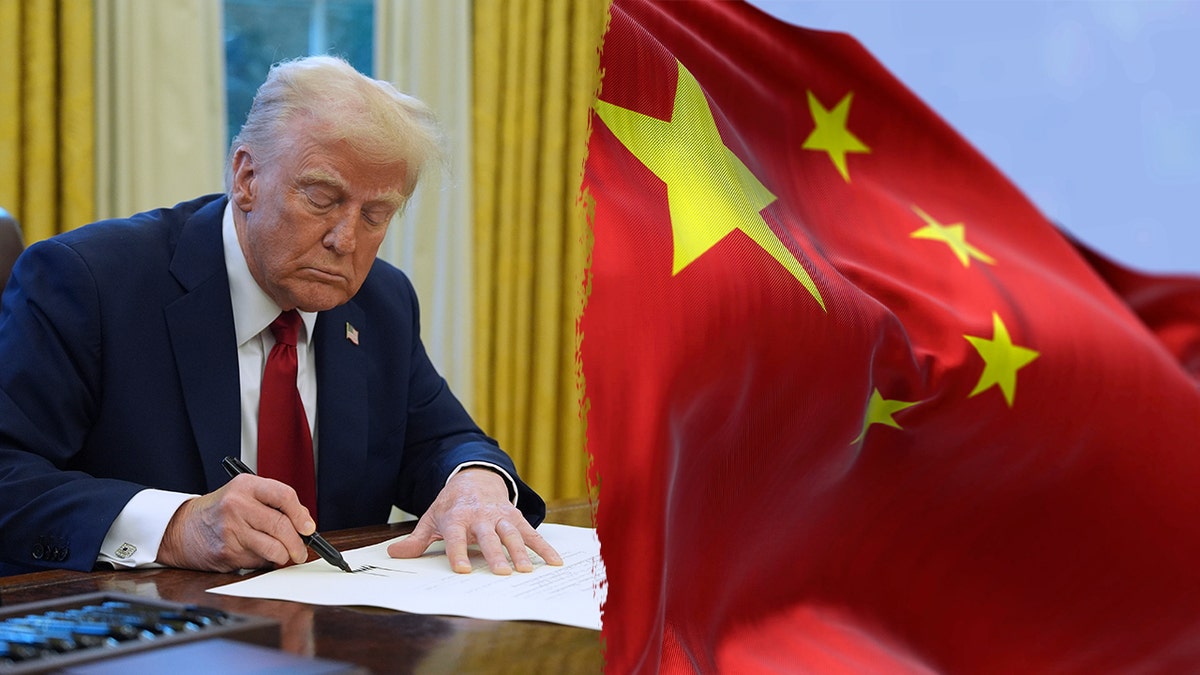

A significant legal challenge against former President Donald Trump's tariffs is underway, with potential ramifications for the U.S. stock market. The lawsuit, filed in Florida, argues that the tariffs imposed during Trump's administration were unconstitutional and seeks their immediate cessation. This legal action has sparked a debate over the authority of the executive branch in setting trade policies, a matter that could soon reach the Supreme Court.

The case has drawn attention from various sectors, including Wall Street, where analysts are closely monitoring the situation due to its potential to influence market stability. The tariffs, initially implemented to protect American industries, have been criticized for their broad economic impact, including increased costs for consumers and retaliatory measures from trading partners.

Legal experts suggest that the outcome of this lawsuit could set a precedent for future trade policy decisions, emphasizing the need for a clear delineation of powers between Congress and the executive branch. As the case progresses, stakeholders from across the political and economic spectrum are bracing for possible shifts in U.S. trade policy.

Detailed

Related issues news

What are tariffs on countries?

Tariffs are taxes charged on goods imported from other countries. Typically, they are a percentage of a product's value. For example, a 25% tariff on a $10 (£7.59) product would mean an additional $2.50 (£1.90) charge. Companies that bring the foreign goods into the country have to pay the tax to the government.

Who has the authority to impose tariffs?

Although the US Constitution grants Congress the authority to levy taxes, including tariffs, Congress has passed laws allowing the President to impose tariffs for national security reasons unilaterally.

When did the president get tariff power?

Beginning in 1917 with the Trading with the Enemy Act of 1917, the president can impose any tariff while the nation is at war.

Are tariffs in the constitution?

Article I, § 10, clause 5 of the United States Constitution, known as the Import-Export Clause, prevents the states, without the consent of Congress, from imposing tariffs on imports and exports above what is necessary for their inspection laws and secures for the federal government the revenues from all tariffs on ...