Wall Street Plunges Amid Trump’s Tariffs: S&P 500 Nears Bear Territory

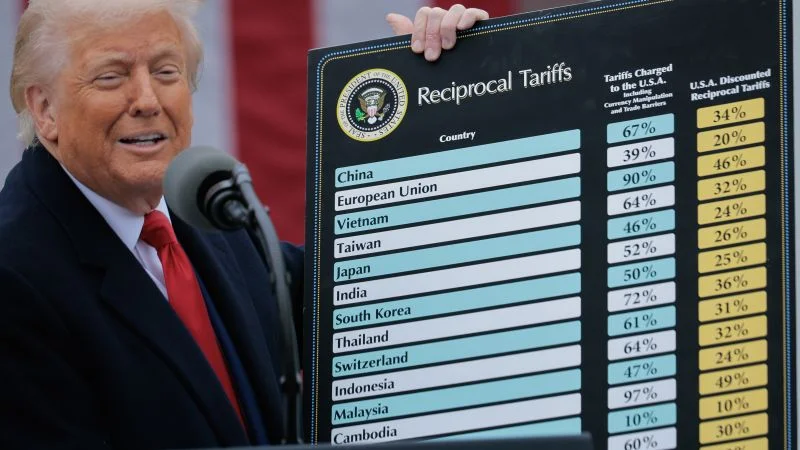

The U.S. stock market experienced a significant downturn on April 7, 2025, as futures plummeted and the S&P 500 approached bear market territory. This sharp decline was triggered by former President Donald Trump's announcement of new tariffs, which sparked a fierce backlash from Wall Street. Investors, already on edge due to ongoing economic uncertainties, reacted strongly to the news, leading to a broad market sell-off.

Reports from Reuters, AP News, NPR, and The Washington Post highlighted the immediate impact of Trump's tariff policies. The S&P 500, a key indicator of market health, saw a significant drop, reflecting investor fears of a potential trade war. Analysts noted that the tariffs could disrupt global trade flows and increase costs for American businesses and consumers.

The market's reaction underscores the sensitivity of financial markets to policy changes, especially those related to international trade. As the situation develops, investors and policymakers alike will be closely monitoring the economic fallout and potential responses from other countries.

Detailed

Related issues news

What are futures in the stock market?

Definition. Futures are derivative financial contracts that obligate parties to buy or sell an asset on a predetermined date at a predetermined price.

What is the stock market?

The stock market is a trading network that connects investors looking to buy and sell stocks and their derivatives. An easy way to think about think about the stock market is to consider it as a network of stock exchanges where traders and investors buy and sell shares of publicly traded companies.

What is bear market territory?

A bear market occurs when stocks fall 20 percent from a recent peak. As global markets continue their meltdown, here's what it means for your money and the economy.

Does the stock market affect pensions?

As you approach retirement age, pension pots tend to be moved to less risky investments, such as government bonds. When stock markets fall, these bonds can do better. Anyone who has a pension pot invested and is taking an income from it will again see their investment go up and down with the stock markets.