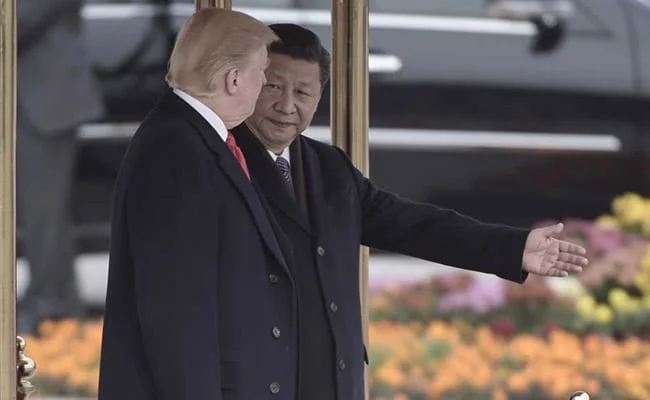

Trump Escalates Trade War with China, Imposes 104% Tariffs

Former President Donald Trump has escalated the ongoing trade war with China by announcing a significant increase in tariffs to 104%. This bold move comes as a response to what Trump described as unfair trade practices by Beijing, aiming to protect American industries and jobs. The decision has sparked a variety of reactions globally, with China indicating it is well-equipped to counter these measures.

Analysts suggest that this escalation could lead to further economic strain between the two nations, potentially affecting global markets. The increased tariffs are set to impact a wide range of Chinese goods entering the U.S., from electronics to industrial products. This development follows a series of back-and-forth tariff impositions that have characterized the U.S.-China trade relationship in recent years.

The announcement has been a focal point in both U.S. and international news, with discussions centering on the potential economic fallout and the strategic positioning of both countries. As the situation unfolds, the global community watches closely to see how Beijing will respond to these heightened trade tensions.

Related issues news

Does China have tariffs?

China Customs assesses and collects tariffs. Import tariff rates are divided into six categories: general rates, most-favored-nation (MFN) rates, agreement rates, preferential rates, tariff rate quota rates, and provisional rates. As a member of the WTO, imports from the United States are assessed at the MFN rate.

What do the tariffs do?

The first is that, like any tax, tariffs raise funds for the U.S. government. Second, because tariffs only apply to imports, they can be used to redistribute money from consumers towards domestic producers.

Does Ukraine have tariffs?

Ukraine imposes several duties and taxes on imported goods: customs/import tariffs, value-added tax (VAT), and excise duties.

When did tariffs begin?

Tariffs and excise taxes were authorized by the United States Constitution and recommended by the first United States Secretary of the Treasury, Alexander Hamilton in 1789 to tax foreign imports and set up low excise taxes on whiskey and a few other products to provide the Federal Government with enough money to pay ...