Trump Initiates New Tariffs on Chinese Imports

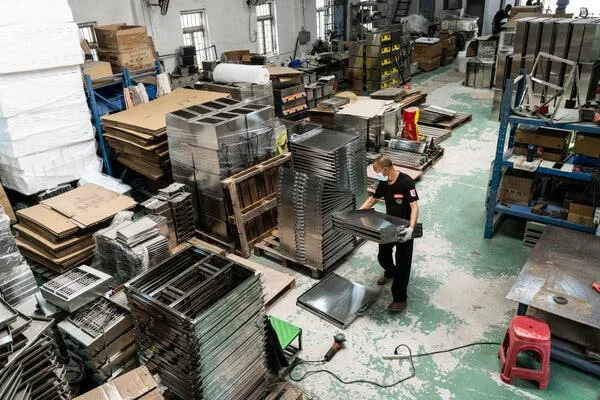

President Donald Trump has introduced a new set of tariffs targeting imports from China, marking a significant escalation in U.S.-China trade tensions. The tariffs, effective immediately, cover a wide range of products, from consumer electronics to industrial components, in response to what the Trump administration describes as unfair trade practices by China.

The announcement has sent ripples through global markets, with stock exchanges reacting variably to the news. Investors are bracing for potential retaliatory measures from China, which could further destabilize the already fragile trade relationship between the world's two largest economies.

In a statement released from the White House, President Trump justified the tariffs as necessary to protect American industries and jobs. The move comes as part of a broader strategy to renegotiate trade terms with China, with the U.S. seeking more favorable conditions for its exports.

The implementation of these tariffs has sparked a deadline for businesses to adjust their import strategies, with many scrambling to understand the full impact on their operations. The global trade community is closely watching the situation, as the outcome could set a precedent for international trade policies.

Related issues news

Does China have tariffs?

China Customs assesses and collects tariffs. Import tariff rates are divided into six categories: general rates, most-favored-nation (MFN) rates, agreement rates, preferential rates, tariff rate quota rates, and provisional rates. As a member of the WTO, imports from the United States are assessed at the MFN rate.

Does Ukraine have tariffs?

Ukraine imposes several duties and taxes on imported goods: customs/import tariffs, value-added tax (VAT), and excise duties.

When did tariffs on China start?

China implemented their tariffs on April 2, 2018. On April 3, 2018, the U.S. Trade Representative's office published an initial list of 1,300+ Chinese goods to impose levies upon, including products like flat-screen televisions, weapons, satellites, medical devices, aircraft parts and batteries.

When did tariffs start?

The Congress passed a tariff act (1789), imposing a 5% flat rate tariff on all imports. Between 1792 and the war with Britain in 1812, the average tariff level remained around 12.5%, which was too low to encourage consumers to buy domestic products and thus support emerging American industries.