Trump’s Tariffs Set to Deepen Global Trade War

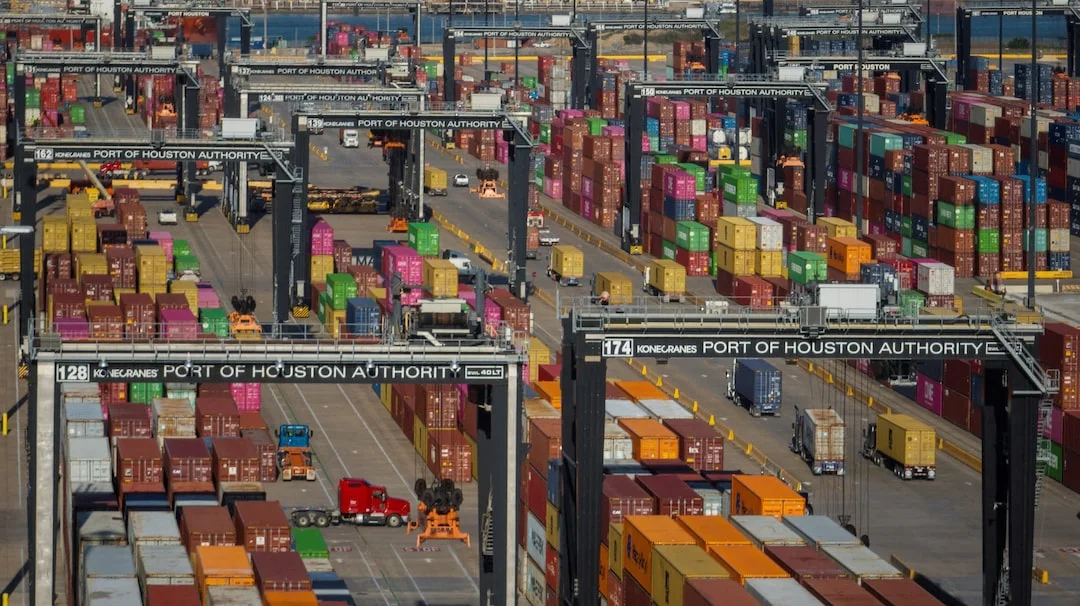

President Donald Trump's latest round of tariffs, announced on April 9, 2025, is poised to intensify the ongoing global trade war. The new tariffs, targeting a broad range of imports, have sent shockwaves through financial markets worldwide, with major indices like the Dow Jones Industrial Average, S&P 500, and Nasdaq experiencing significant declines.

The FTSE 100 in the UK also felt the impact, with stocks plummeting as investors reacted to the news. Analysts warn that these tariffs could lead to a 700-point dive in the Dow, reflecting broader concerns about the stability of the global economy. Treasury yields have spiked in response, indicating heightened market volatility.

The escalation in trade tensions comes at a time when many economies are still recovering from previous disruptions. The move has been met with criticism from various quarters, with fears that it could lead to retaliatory measures from other nations, further complicating international trade relations.

Related issues news

What is a bear stock market?

A bear market is a Wall Street term used to describe a market downturn when a stock index, such as the S&P 500 or the Dow Jones Industrial Average, has fallen 20% or more from a recent high for a sustained period of time. Because bears hibernate, they are used to describe a stock market that's retreating.

Is S and P in a bear market?

The S&P 500 briefly dipped into bear territory on Monday, but it didn't close low enough to be considered a bear market. As of Tuesday's close, the S&P 500 was down nearly 19% from its February high, just below the 20% threshold.

Is the Nasdaq in a bear market?

The Nasdaq Composite (NASDAQINDEX: ^IXIC) is officially in a bear market. While it had been floating around in correction territory for a few weeks, it fell more than 20% below its all-time high after President Donald Trump announced his new tariff plan on April 2.

What to do when the stock market crashes?

While it's perfectly fine to do nothing at all in a market downturn, it can also be a good idea to start looking for places to put money to work. That's especially true when the market has already fallen into bear market territory, like now.