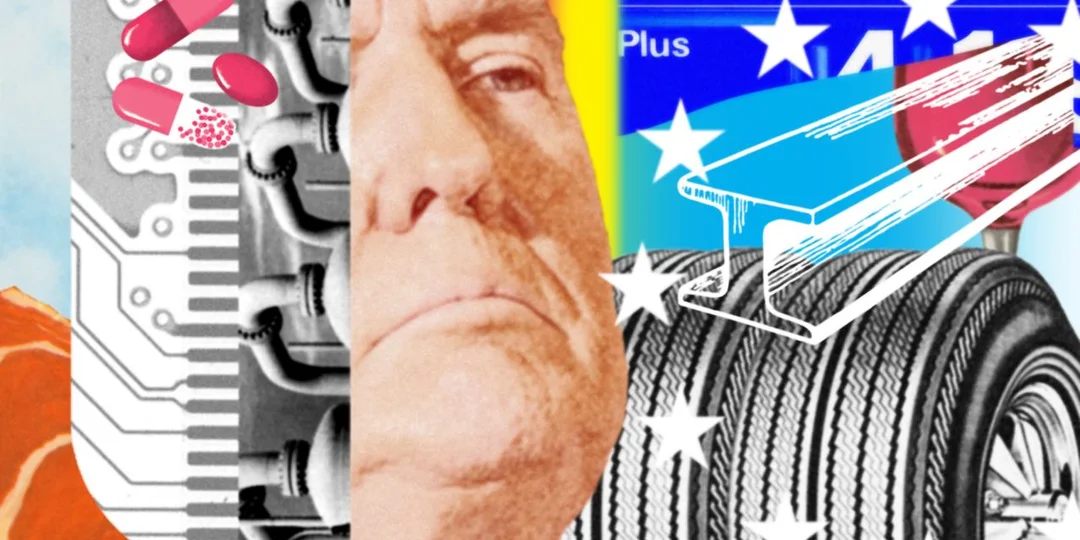

Trump’s Tariffs Trigger Tumble in Asian Markets

President Donald Trump's recent imposition of tariffs on Chinese goods has sent shockwaves through Asian financial markets, leading to significant declines in stock values across the region. The tariffs, aimed at reducing the U.S. trade deficit with China, have sparked fears of a broader trade war that could destabilize global economic growth.

Stock markets in major Asian cities like Hong Kong, Shanghai, and Tokyo experienced sharp drops as investors reacted to the news. Analysts are concerned that these tariffs could lead to retaliatory measures from China, further escalating tensions and impacting global trade. The uncertainty has led to a sell-off in equities, with many investors moving their assets to safer investments.

The Trump administration argues that these tariffs are necessary to protect American industries and jobs from what they describe as unfair trade practices by China. However, critics warn that the move could backfire, hurting U.S. consumers and businesses that rely on Chinese imports.

Related issues news

Does Ukraine have tariffs?

Ukraine imposes several duties and taxes on imported goods: customs/import tariffs, value-added tax (VAT), and excise duties.

What is a trade war?

A trade war is an economic dispute between two countries. It can occur when one country retaliates against another's perceived unfair trading practices with restrictions, such as tariffs, on imports.

When did US tariffs start?

The Tariff Act of 1789 imposed the first national source of revenue for the newly formed United States. The new U.S. Constitution ratified in 1789, allowed only the federal government to levy uniform tariffs.

Why do tariffs affect the stock market?

Wall Street fears a hit to growth The fear is that tariffs will dent growth for publicly listed companies and the broader U.S. economy. Wall Street has raised its odds for a U.S. recession. Tariffs are a tax paid by U.S. companies that import goods from abroad, and they therefore raise costs for U.S. businesses.