California Wildfire Victims Turn to the Courts as Smoke Damage Coverage Dispute Grows

Homeowners in Southern California devastated by the January wildfires are now embroiled in a tense legal battle with California’s Fair Plan, the state’s insurer of last resort. A recently filed lawsuit shines a light on what many allege is a systematic denial of smoke damage claims, raising pressing questions about insurance practices in the wake of increasingly destructive wildfires.

The heart of the dispute lies not in homes charred beyond recognition but in properties that, though still standing, were invaded by harmful smoke and toxic debris. Kathleen Jordan, one such homeowner in Altadena, thought her family had narrowly dodged the worst. Yet months after the fire, their home remains unlivable—covered in soot and chemical residue. “We sort of celebrated thinking we were in this really lucky group of people, only to find out later that that is not at all the case,” said Jordan. Instead of a safe return, she faces a bureaucratic maze and an insurer unwilling, in her view, to pay what’s owed.

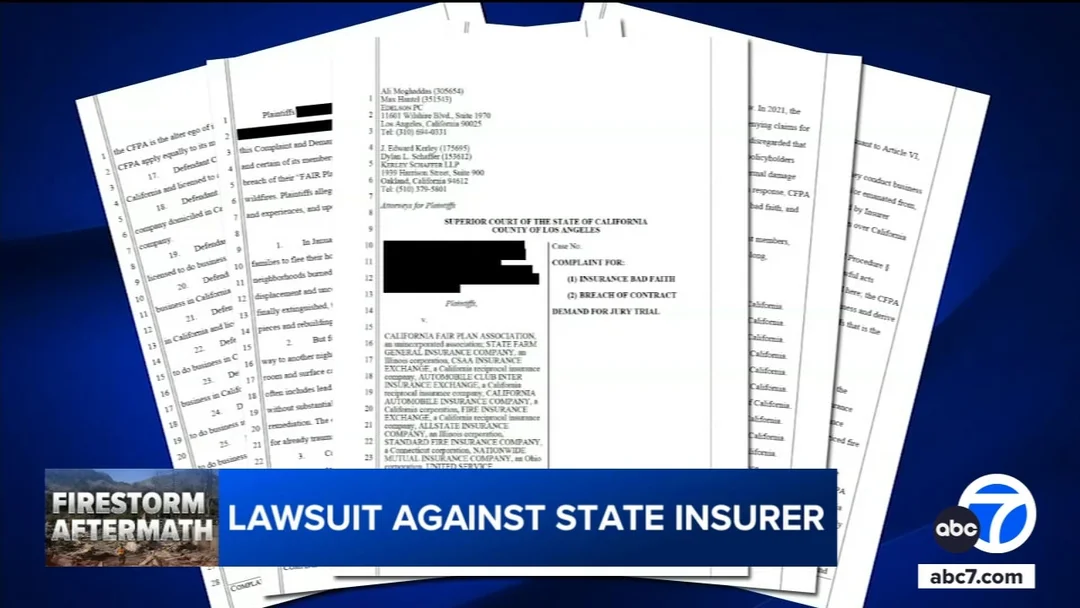

Jordan and her husband are among ten plaintiffs in a Los Angeles County Superior Court suit alleging insurance bad faith and breach of contract. The complaint contends that the California Fair Plan and ten major home insurers have refused to properly investigate or cover cleanup of extensive smoke and ash contamination, transforming survivors’ homes into “toxic traps.”

Other residents, like Saul Kerpelman of Pacific Palisades, echo the same frustration. “The FAIR Plan's position is that houses that did not burn to the ground are not damaged, they're dirty,” he said. Kerpelman worries about profound contamination, as adjusters allegedly advised residents to simply “pick up a broom and sweep,” advice claimed to be inadequate and unsafe. Elizabeth Carlton, another plaintiff, discovered that windblown ash had brought lead into her home, further complicating cleanup efforts and raising health concerns. According to attorney Dylan Schaffer, restoring such homes can require costly professional remediation—even removal of building materials like insulation and ducts.

The dispute centers on the Fair Plan’s interpretation of “direct physical loss.” Starting in 2017, the insurer reportedly narrowed its coverage definition, requiring “permanent physical changes” for a claim to be approved. Critics say this has allowed a systematic denial of smoke claims—even after state regulators cautioned that the restriction was illegal. A regulatory exam reportedly found over 400 violations of insurance standards by the Fair Plan since 2017.

For its part, the Fair Plan maintains that it pays all covered claims consistent with state law and policy forms approved by the insurance department. “Our policy and approach to direct physical loss is consistent with other insurers,” stated spokesperson Hilary McLean. Yet, as the number of lawsuits and consumer complaints grows, pressure mounts for the state to clarify rules and protect vulnerable homeowners.

The lawsuit is far from the first of its kind, but it comes amid a surge in litigation following catastrophic wildfires and as more insurers withdraw from fire-prone areas, leaving Fair Plan as the last option for many. With billions of dollars in claims looming, the outcome could shape how future fire survivors are treated—and whether the very definitions of insurance coverage can adapt to California’s new wildfire reality.

The current standoff leaves many residents in limbo, with homes unfit to return to and little recourse but the courts. Will this lawsuit spur overdue reforms, or will a patchwork of legal battles become the new normal? Readers: What protections should wildfire victims expect from insurers, and how can the system improve? Leave a comment below and join the conversation.