What Does Nvidia’s Export Block to China Mean for Global Markets?

In a significant shift that could reshape the landscape of global technology trade, Nvidia's announcement regarding export restrictions to China has sent shockwaves through financial markets. This development is not just another corporate regulatory hurdle; it underlines the escalating tensions in U.S.-China relations and the profound impact these geopolitical dynamics can have on the economy.

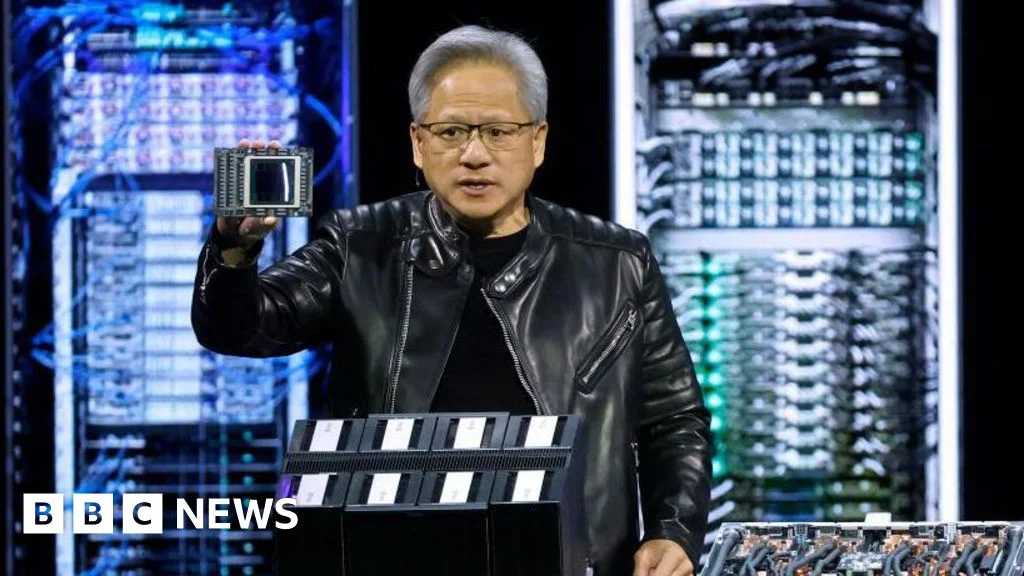

On April 16, 2025, Nvidia, a major player in the semiconductor industry, revealed that the U.S. government would require licenses for it to sell certain chips, particularly its H20 artificial intelligence chip, to China. This governmental intervention comes as part of an ongoing strategy to tighten controls on sensitive technology exports, marking the first significant restriction President Trump’s administration has imposed on semiconductor sales abroad. Nvidia expects to incur a staggering $5.5 billion loss due to unfulfilled orders and unsellable chip inventories, leading to a notable decline in its stock, which fell over 6% in after-hours trading.

The repercussions of this move extend beyond Nvidia. The shares of ASML, a key supplier of machinery for semiconductor production, also tumbled more than 6% following a statement regarding order expectations not being met. This suggests that the entire sector is bracing for a potential decline in productivity and revenue, particularly as markets grapple with fears of a heightened trade war.

Investor sentiment has understandably soured, with futures for major indexes such as the Dow Jones, S&P 500, and Nasdaq all witnessing declines. With the S&P 500 futures down more than 1% and significant sell-offs observed in Asia-Pacific indexes, the cascading effect of Nvidia’s restrictions is painting a bleak picture for tech stocks globally.

The Bank of America’s survey reflects this growing unease, noting that global investors have significantly reduced their U.S. stock holdings in anticipation of a recession triggered by ongoing trade tensions. As President Trump continues to navigate these intricacies, including tariffs on imports and negotiations with other trading partners, market anxiety only amplifies.

Furthermore, Trump's unpredictable tariff policies are exacerbating uncertainties. Exemptions and new tariffs loom over critical sectors, including pharmaceuticals and essential minerals, which are integral to technological advancements. With both the U.S. and China seemingly unwilling to back down, analysts warn that the current stalemate may prolong investor fears, impacting global economic stability.

As markets react to these tumultuous shifts, one must ask: How will companies like Nvidia navigate this increasingly hostile trade climate? Will they adapt, or will they find themselves sidelined in the global AI race?

The future remains uncertain, but one thing is clear: with monumental players like Nvidia at the forefront of this battle, the implications are vast, affecting not only tech industries but potentially the economy as a whole. Stakeholders are encouraged to assess the developments closely and weigh in on what steps should be taken next. What are your thoughts on Nvidia's role and the broader ramifications in the tech sector? Join the conversation by sharing your insights!

Related issues news

What is NVDA H20?

The H20 is an AI chip specifically for the China market to comply with strict export controls developed under the Biden administration. The H20 is similar to the H100 Hopper chip used in the U.S. and most other markets, but with slightly slower speeds. Both are a step down from Nvidia's new Blackwell chips.

Why is Nvidia down?

It Got Bad News About Its H20 Chips From the Government. disclosed in an SEC filing Tuesday evening that future sales of its H20 AI accelerators to China would require a license from the U.S. Department of Commerce. The licenses are unlikely to be forthcoming.