Is the Semiconductor Industry on the Brink of Collapse?

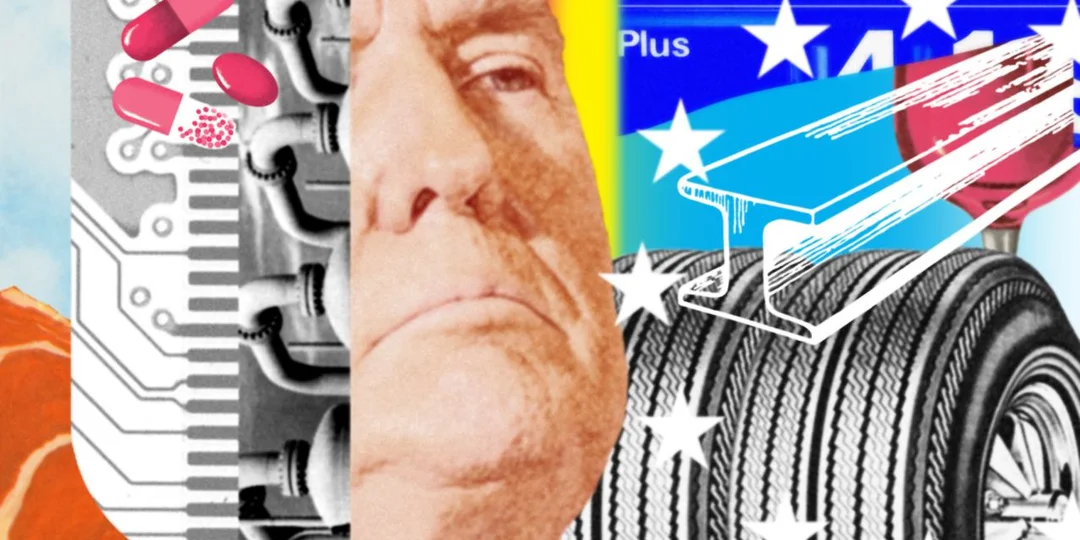

In recent weeks, the semiconductor industry has faced unprecedented turmoil, culminating in substantial stock market declines following new trade restrictions imposed by former President Donald Trump on Nvidia, the leading AI chipmaker. This move has not only sent shockwaves across the tech sector but has also sparked concerns regarding the future of global trade and economic growth.

US stocks plummeted as investors reacted to the news. The S&P 500 dropped approximately 1.3%, while the tech-heavy Nasdaq fell by 2.1%, reflecting the deep-seated anxieties within the industry. Nvidia itself saw a staggering loss, with its shares diving about 7%—translating to billions in market value.

The restrictions stem from a recent decision by the Trump administration mandating that Nvidia obtain special licenses to export its H20 chip to China. This unexpected regulatory shift has left many industry insiders shaken, leading Nvidia to project a $5.5 billion loss due to the imposed costs and penalties related to unfulfilled orders. Interestingly, the company had anticipated that its H20 chips could evade scrutiny based on prior discussions with Trump.

As the situation evolved, other major players in the industry were not spared. Advanced Micro Devices (AMD) also reported a potential financial impact of up to $800 million as the new rules tightened their market access. South Korean giants like Samsung Electronics and SK Hynix, as well as European semiconductor firms such as ASML, saw their stock prices drop significantly, illustrating the far-reaching consequences of US trade policy.

Despite the negative outlook for the semiconductor industry, some segments of the economy showed resilience. The latest retail sales data indicated a 1.4% increase in March, suggesting that consumers may be buying in anticipation of further price hikes linked to these tariffs. However, the uncertainty surrounding trade policies continues to cloud economic forecasts, with the World Trade Organization predicting a contraction in global trade growth.

Furthermore, the competitive landscape in China may also shift dramatically. Local tech giants are scrambling to find alternatives to Nvidia's chips, potentially boosting domestic manufacturers like Huawei. Observers note that if Chinese firms were to pivot towards homegrown solutions, the implications could be profound for the global semiconductor market.

As Donald Trump prepares for a trade meeting with Japan, further developments in this saga are forthcoming. Governor Gavin Newsom of California has already initiated a legal challenge against the tariffs, emphasizing the contentious nature of these emerging trade policies.

In a market that thrives on stability and predictability, the current landscape is anything but. As the semiconductor industry grapples with operational disruptions and regulatory challenges, the broader implications of these export controls raise significant questions about the future of global trade and economic collaboration. Will the semiconductor industry rebound, or are we witnessing the onset of prolonged challenges?

We invite readers to share their thoughts on how these trade dynamics will shape the tech landscape. What are your insights on the potential fallouts from the recent restrictions?

Related issues news

What is the Nvidia H20?

The H20 is an AI chip specifically for the China market to comply with strict export controls developed under the Biden administration. The H20 is similar to the H100 Hopper chip used in the U.S. and most other markets, but with slightly slower speeds. Both are a step down from Nvidia's new Blackwell chips.

What is the H20 chip?

Nvidia's H20 chip is a less powerful version of Nvidia's market-leading AI accelerators designed for the Chinese market. It is still very powerful. These chips can work together over high-speed connections.