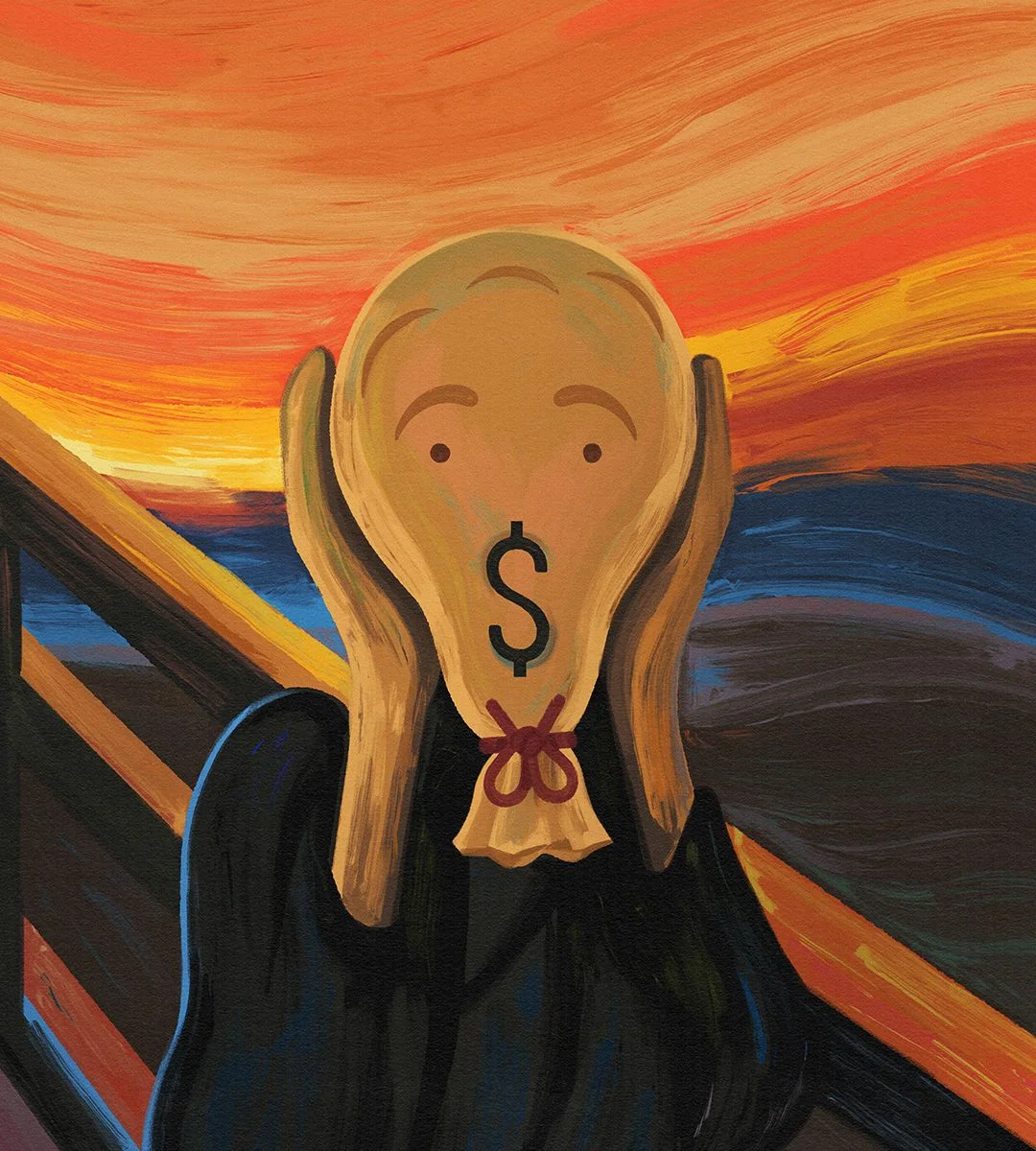

Is the Dollar’s Decline a Signal of Trust Erosion in the U.S. Economy?

NEW YORK (AP) — The recent decline of the U.S. dollar has raised eyebrows, invoking concerns about potential investor distrust amidst the backdrop of President Donald Trump's trade policies. With the dollar having plunged nearly 9% against a collection of major currencies since January, experts are questioning whether this trend signifies a crucial tipping point for the global reserve currency.

The importance of the dollar in global finance cannot be overstated; it has long held the position of a safe haven, supported by decades of confidence fostered by successive U.S. administrations. Barry Eichengreen, an economist from the University of California, Berkeley, highlighted the fragile nature of this trust: “Global trust and reliance on the dollar was built up over a half century or more, but it can be lost in the blink of an eye.”

Alarmingly, while traditional economic patterns would suggest a strengthening dollar amid rising tariffs, the reality has been a perplexing decline. Data indicates the dollar has weakened by over 5% against European currencies and even more against the Japanese yen since April, showcasing a clear departure from expected market behavior.

This shift is troubling for everyday American consumers, who increasingly find themselves paying more for imports — from French wines to South Korean electronics — not only due to tariffs but also exacerbated by the weakening of the dollar. The implications stretch further, potentially resulting in higher interest rates for loans as lenders factor in increased risk from currency instability.

Compounding these issues are U.S. federal debt levels, now at a staggering 120% of annual economic output. Benn Steil from the Council on Foreign Relations warned, “Most countries with that debt to GDP would cause a major crisis, and the only reason we get away with it is that the world needs dollars.” The concern is that if alternatives arise, notably from countries such as China that have been forming yuan-only trading arrangements, the dollar’s dominance is at genuine risk.

Interestingly, not all economists attribute the dollar's decline to waning trust. Steve Ricchiuto of Mizuho Financial suggested that the weakness stems from inflation anticipations due to tariffs. Yet, he acknowledges the absence of a viable alternative currency that could step in should the dollar's condition further deteriorate: “The U.S. will lose the reserve currency when there is someone out there to take it away.”

Despite skepticism regarding the cause, the erratic nature of current U.S. trade policies may adversely impact investor confidence. The unpredictability associated with tariffs and pressures on the Federal Reserve have fueled anxieties about the U.S. financial landscape.

As this narrative unfolds, it invites significant questions: Could we be witnessing the beginning of a major shift in global financial dynamics? With the potential for a “confidence crisis” looming, as warned by Deutsche Bank, the dollar's downturn could reshape economic relations worldwide and redefine what it means to hold the world’s reserve currency.

In a rapidly evolving economic environment, how should investors and traders adjust their strategies to safeguard against these uncertainties? Share your thoughts below!

Related issues news

Is the US dollar weakening?

The US dollar's weakness against its major peers during the first quarter of 2025 is anticipated by Goldman Sachs Research to persist. Over the next 12 months, the US currency is forecast to fall about 10% versus the euro, and around 9% against the Japanese yen and British pound (as of April 8).

What does the weak dollar mean for the global economy?

A weak dollar makes the profits that foreign companies earn from their U.S. divisions worth less when translated back into euros or yen. It also makes the goods they produce more expensive for American consumers.

Why is the US dollar falling?

'The dollar is losing value because the Federal Reserve is lowering interest rates and therefore imports will be more expensive,' said financial adviser David Gustin, of Jericho-based DMG Portfolio Management, who explained that lower interest rates make the dollar less valuable to foreign investors.

What does a weak dollar mean?

A weaker U.S. dollar buys less foreign currency than it did previously. This makes goods and services (and assets) produced in foreign countries relatively more expensive for U.S. consumers, which means that U.S. producers that compete with imports will likely sell more goods (such as American cars) to U.S. consumers.