Florida’s Immigrants Contribute Billions in Taxes, Report Finds

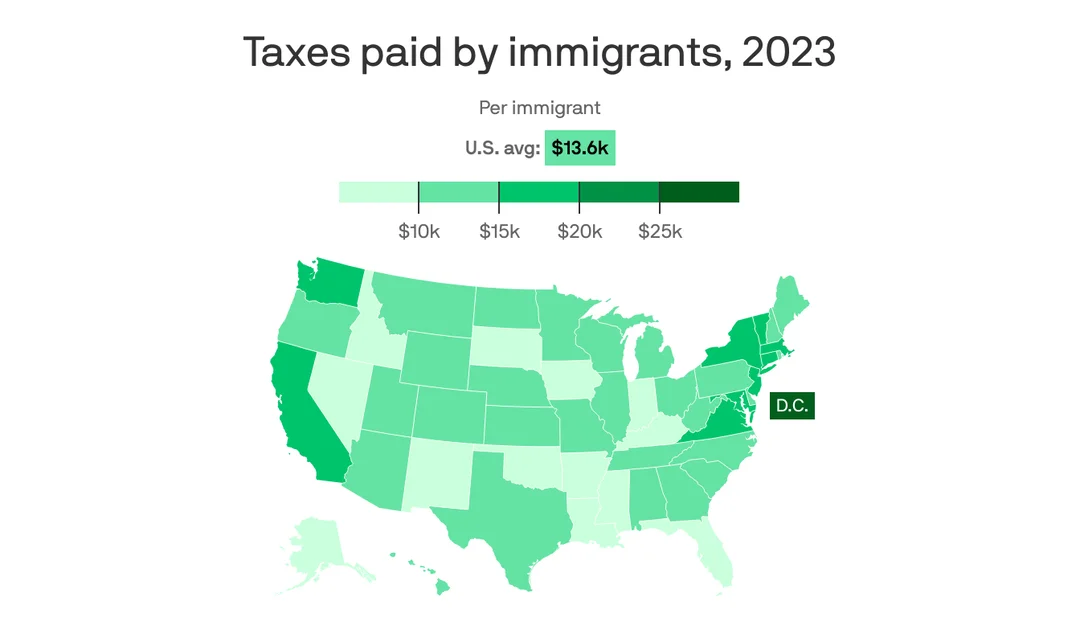

A recent report has shed light on the significant economic contributions made by immigrants in Florida, revealing that they pay billions in taxes annually. The study, conducted by a coalition of researchers and advocacy groups, underscores the vital role that immigrants play in the state's economy.

According to the report, immigrants in Florida contribute approximately $12.9 billion in federal taxes and $6.9 billion in state and local taxes each year. These figures highlight the substantial fiscal impact of the immigrant population, which often goes unnoticed in public discourse. The report also emphasizes that these contributions are essential for funding public services and infrastructure across the state.

The findings come at a time when immigration policies and their economic implications are hotly debated at both state and national levels. Advocates argue that these numbers should inform policy decisions, promoting a more inclusive approach to immigration that recognizes the economic benefits. Critics, however, maintain that the focus should be on the strain that immigration can place on public resources.

The report further breaks down the tax contributions by immigrant status, showing that undocumented immigrants alone pay an estimated $1.6 billion in state and local taxes. This detail challenges common misconceptions about the economic impact of undocumented immigrants, suggesting they are net contributors to the economy.

This study is part of a broader effort to provide data-driven insights into the economic role of immigrants in the United States. As Florida continues to be a focal point for immigration-related issues, this report serves as a crucial reference for policymakers, stakeholders, and the public.