California Bills Aim to Boost Hollywood Production with Tax Credits

California is taking significant steps to rejuvenate its film and television industry with a series of new bills aimed at enhancing production through tax incentives. These legislative efforts, poised to revitalize Hollywood, include proposals to modernize the state's film and TV tax credit system. Key among them is a bill that could potentially increase the tax credit rate to up to 35% for certain productions, particularly targeting animation and sitcoms.

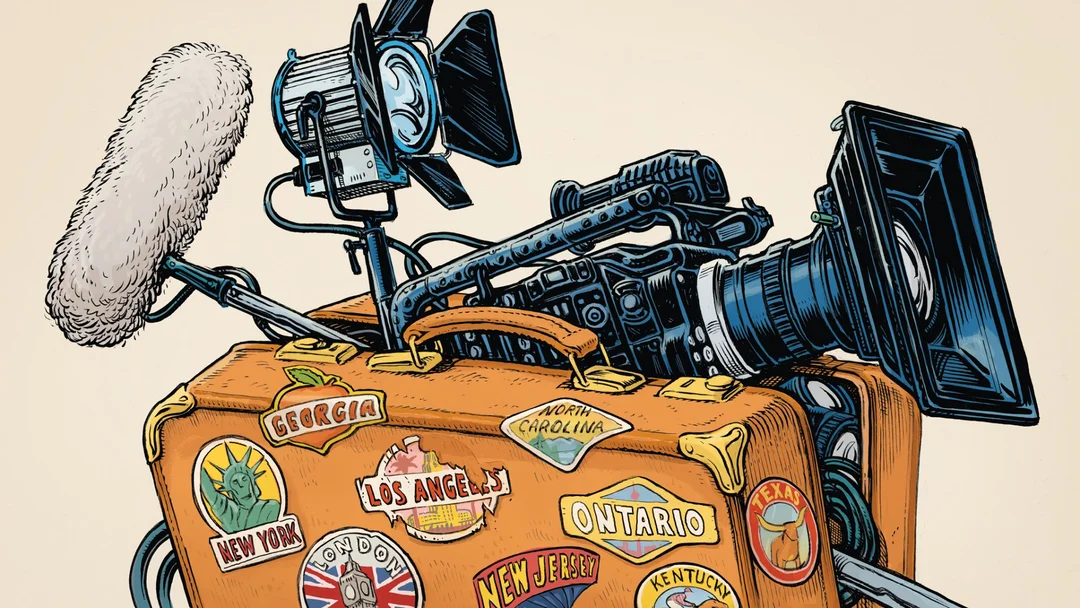

This move comes as a response to the competitive landscape of film production, where states like Georgia and New York have been drawing productions away from California with their own attractive tax incentives. The proposed changes to the tax credit system are designed not only to keep productions within the state but also to encourage new ones, potentially leading to job creation and economic growth in the entertainment sector.

Additionally, these bills aim to address the evolving needs of the industry, including provisions for safety measures and diversity initiatives on set. The legislative push reflects California's commitment to maintaining its status as a global hub for entertainment while adapting to modern industry standards and challenges.