Canada Faces U.S. Tariffs: Impact on Auto Industry and Economy

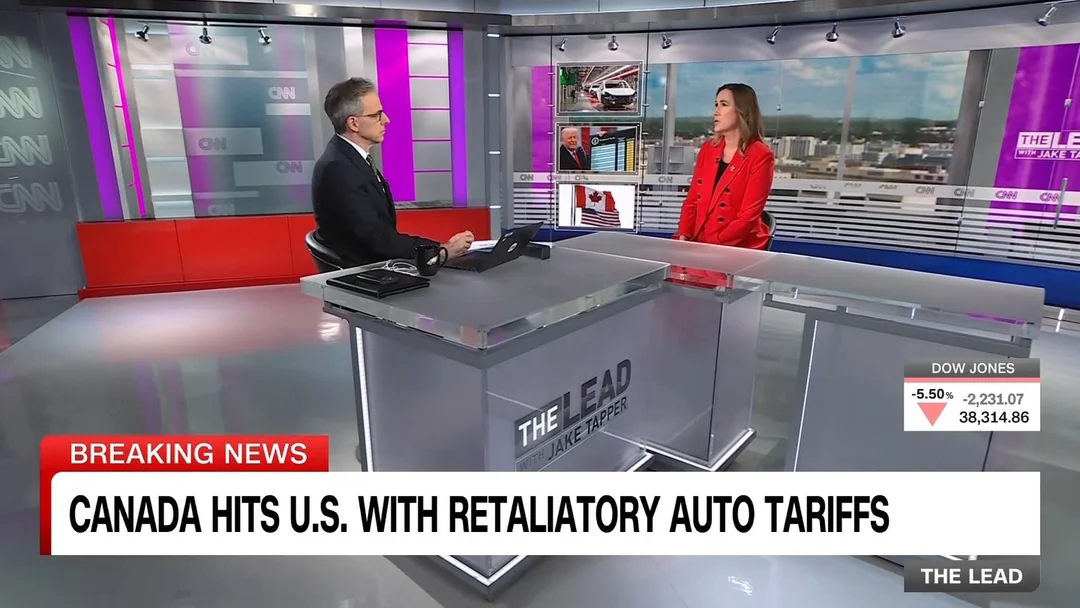

The U.S. has imposed new tariffs on Canada, affecting the auto industry in Windsor and potentially leading to broader economic repercussions. The tariffs, part of a broader trade strategy, have sparked concerns about the future of cross-border trade between the two nations. According to The New York Times, these tariffs could significantly disrupt the supply chain in the auto sector, a critical component of Windsor's economy.

Politico reports that the U.S. and Canada's friendship is being tested by these economic measures, with fears that a trade war could escalate. Mark Carney, a prominent figure in Canadian economics, has warned that the tariffs might push the U.S. towards a recession, as mentioned by CBC News. The Wall Street Journal notes that despite these tensions, the USMCA exemption continues for Canada and Mexico, providing some relief but not enough to quell economic fears.

The situation remains fluid, with stakeholders on both sides of the border anxiously awaiting further developments. As the auto industry braces for impact, the broader economic implications of these tariffs are yet to be fully realized.

Related issues news

Why are Canada and Mexico tariffs?

Trump has said the tariffs are intended to reduce the U.S.'s trade deficit with Canada and Mexico, force both countries to secure their borders with the U.S. against illegal immigration and fentanyl smuggling, and promote domestic manufacturing in the United States.

What is Canada's tariff rate?

Canada is exempt from the reciprocal tariffs and the baseline 10% rate. Instead, Canada will continue to be subject to the 25% “fentanyl/illegal immigration” tariff, with 10% on energy and carve outs for USMCA compliant goods.

Are autos USMCA compliant?

However, vehicles produced prior to 2020 are not likely to meet all USMCA rules of origin. Vehicles produced on or after July 1, 2020, may meet the USMCA rules of origin. Under the USMCA Implementation Act, there are three vehicle certifications that must be provided by the producer of the covered vehicle.

What do the tariffs do?

Tariffs on imports are designed to raise the price of imported goods to discourage consumption. The intention is for citizens to buy local products instead, thereby stimulating their country's economy. Tariffs therefore provide an incentive to develop production and replace imports with domestic products.