Florida’s Budget Battle Intensifies As DeSantis And Lawmakers Clash Over Billion-Dollar Tax Cuts

Florida’s annual legislative session is underway, but instead of smooth sailing toward a balanced budget, Tallahassee is witnessing one of the most contentious fiscal showdowns in recent years. With billions on the line, Governor Ron DeSantis, House Speaker Daniel Perez, and Senate President Ben Albritton find themselves at odds over deep tax cuts, competing budget proposals, and the state’s economic future — a clash that echoes far beyond the Capitol walls.

At the heart of this conflict are two diverging visions for how best to provide tax relief while safeguarding Florida’s finances. The Florida House, led by Speaker Perez, unanimously advanced a landmark bill slashing the state’s sales tax from 6% to 5.25%, a permanent cut billed as historic, totaling roughly $5 billion per year. "It is $5 billion of real cutting going back to the people...the first time this has ever been done in the U.S.," Perez emphasized with pride, noting additional reductions in commercial rent, non-residential electricity, mobile homes, and amusement machines.

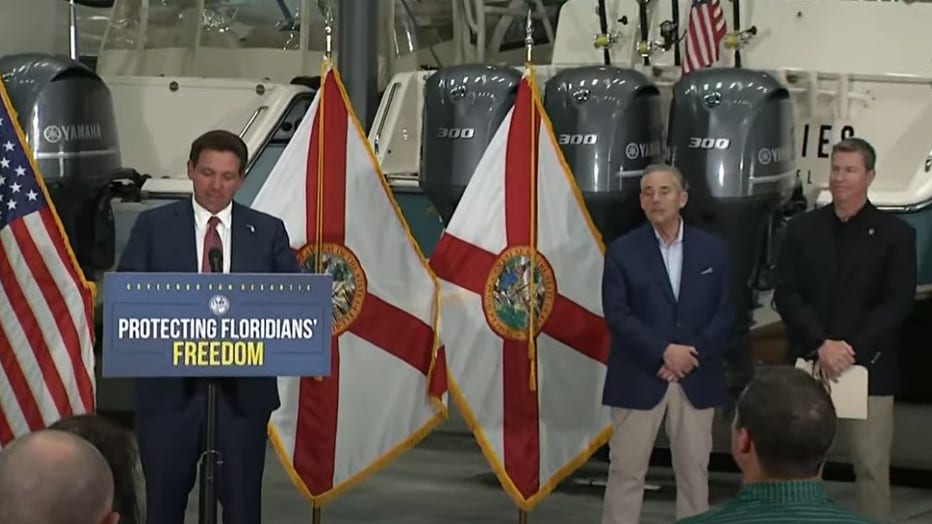

Meanwhile, Governor DeSantis insists on prioritizing property tax cuts, targeting relief for Florida homeowners strained by rising bills. During a recent stop in Panama City Beach, he accused lawmakers of being obstructionists, criticizing the sales tax plan as a gift to "Canadian tourists and nonresidents" instead of struggling Floridians. "People are getting killed on property taxes. So because I’m doing property, they’ve got to do something else," DeSantis said pointedly. Instead, he has called for a one-time $1,000 property tax rebate benefiting 5.1 million homeowners and proposed a 2026 ballot measure for permanent relief, staking his political clout on the issue after his failed presidential bid.

Senate President Albritton occupies a cautious middle ground. The Senate favors a $117.4 billion budget — larger than the House’s $113 billion plan and the governor’s $115.6 billion blueprint — but questions whether sweeping, permanent tax cuts are sustainable amid economic uncertainty. He recently urged his chamber to favor nonrecurring, flexible relief instead of cuts that could risk fiscal stability. "I believe it is prudent...to be predominantly nonrecurring, while permanent tax cuts are explored during the interim," Albritton wrote, wary of a future downturn exacerbated by national trade tensions and Trump’s tariff policies.

Beyond tax cuts, the budget debate involves billions more: about $4 billion is earmarked for the state’s sprawling school voucher program supporting over half a million students, underscoring Florida’s ambitious—and costly—education agenda.

Underpinning all this is political calculus. For DeSantis, term-limited and politically bruised, exerting influence over the budget is critical to shaping his legacy. Speaker Perez, emboldened after restoring millions of dollars in vetoed projects and pushing conservative fiscal reforms, sees his tax strategy as transformative for Floridians’ long-term economic health. Their disagreement is not just about numbers but about the philosophical divide between targeted relief for homeowners and broad consumption tax cuts benefiting a wider population, including visitors.

Under the Florida Constitution, lawmakers must finalize negotiations by April 29, leaving only 72 hours for a mandatory review before the session adjourns on May 2. With such a compressed timeline, pressure is building to reconcile a budget over $4 billion apart and reach consensus amid economic and political uncertainties.

As the clock ticks, the question remains: can Florida’s leaders find common ground on a tax and spending plan that withstands economic headwinds while easing the burden on Floridians? Or will this showdown leave taxpayers caught in the crossfire? Share your thoughts below and join the conversation on the Sunshine State’s high-stakes fiscal future.