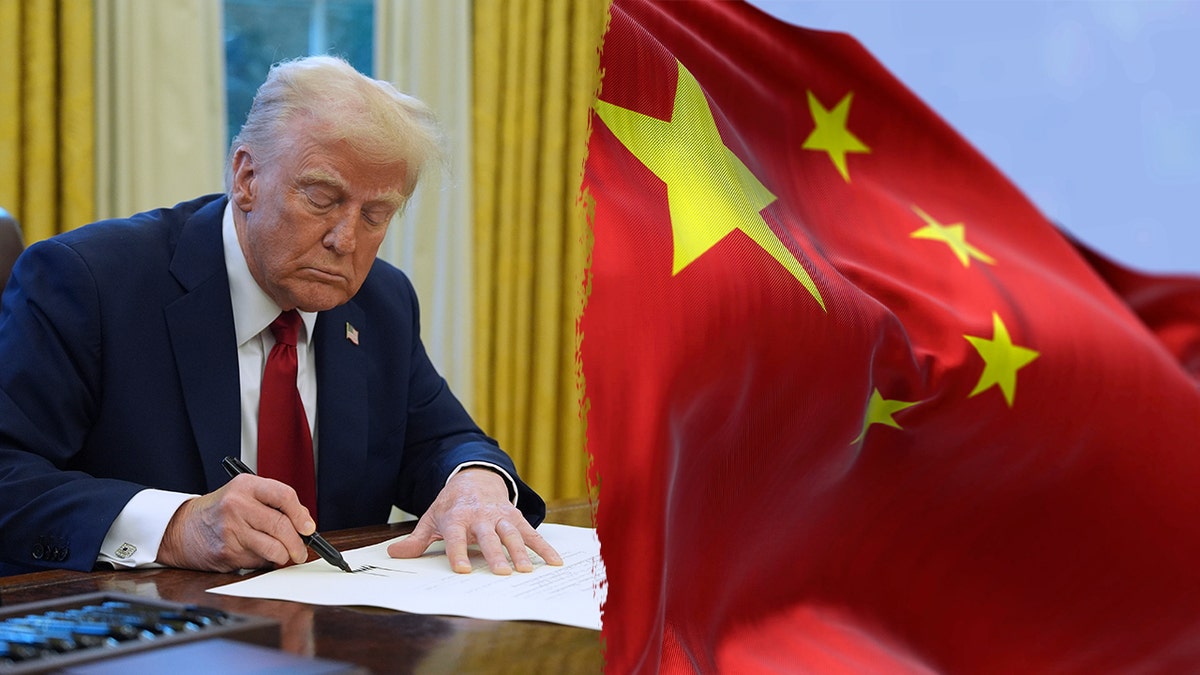

Legal Challenges Mount Against Trump’s China Tariffs

Former President Donald Trump's proposed tariffs on Chinese goods are facing significant legal challenges, raising questions about their legality and economic impact. The New Civil Liberties Alliance (NCLA) has filed a lawsuit against the tariffs, arguing that they were implemented without proper congressional approval. This legal action comes amidst growing concerns from conservative groups and economists about the potential negative effects on the U.S. economy.

The Washington Post reports that the tariffs, which Trump claims are necessary to protect American industries, are being contested on the grounds that they exceed the executive branch's authority. The Economist suggests that the legal battle could extend to the Supreme Court, potentially setting a precedent for future trade policies.

The BBC highlights that the controversy surrounding the tariffs is not only about their legality but also their economic justification. Critics argue that the tariffs could lead to higher prices for consumers and retaliatory measures from China, further straining international relations.

As the legal challenges unfold, the outcome will likely have significant implications for U.S. trade policy and the broader economic landscape.

Detailed

Related issues news

Are tariffs in the constitution?

Article I, § 10, clause 5 of the United States Constitution, known as the Import-Export Clause, prevents the states, without the consent of Congress, from imposing tariffs on imports and exports above what is necessary for their inspection laws and secures for the federal government the revenues from all tariffs on ...

What are tariffs on countries?

Tariffs are taxes charged on goods imported from other countries. Typically, they are a percentage of a product's value. For example, a 25% tariff on a $10 (£7.59) product would mean an additional $2.50 (£1.90) charge. Companies that bring the foreign goods into the country have to pay the tax to the government.