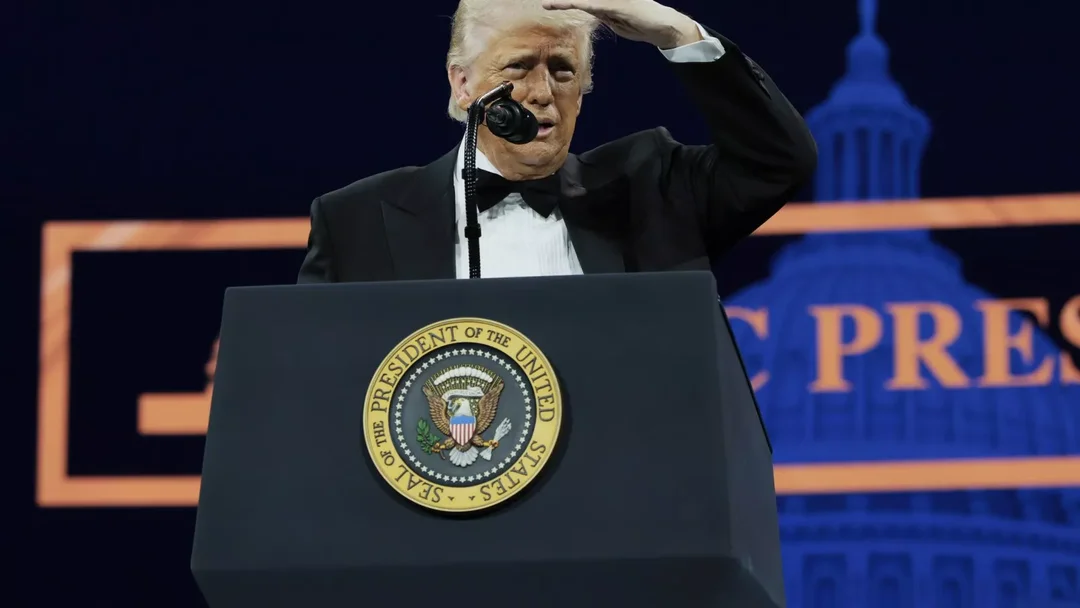

Trump’s Tariff Policies Stir Financial Markets

Former President Donald Trump's proposed tariff policies have caused significant fluctuations in the U.S. financial markets, according to recent reports. Newsweek highlights that Trump's administration's consideration of new tariffs has led to live updates on stock market reactions, with investors closely monitoring potential impacts on various sectors.

CNBC reports live updates on how these tariffs could affect the economy, with particular attention to the bond market, which Rolling Stone notes has been cratering in response to the proposed measures. The Independent also covers the broader implications of these tariffs, especially concerning international trade with China and the domestic sectors like pharmaceuticals and coal.

The proposed tariffs are part of Trump's strategy to protect American industries, but they have sparked concerns about potential retaliatory measures from trading partners and the overall health of the global economy. As the debate continues, financial analysts and policymakers are closely watching the developments, trying to predict the long-term effects on both the U.S. and world markets.

Related issues news

What date did Trump announce tariffs?

On April 2—a day he called 'Liberation Day'—Trump signed an executive order imposing a minimum 10% tariff on all U.S imports beginning April 5.

When did Trump put tariffs on China?

On April 2, 2025, the Trump administration brought the total import tariff on China to 54%, with the Chinese government vowing retaliation in response. On April 9, 2025, the U.S. imposed a 125% tariff on Chinese goods, while China imposed a 84% tariff on American goods.

Does China have tariffs?

China Customs assesses and collects tariffs. Import tariff rates are divided into six categories: general rates, most-favored-nation (MFN) rates, agreement rates, preferential rates, tariff rate quota rates, and provisional rates. As a member of the WTO, imports from the United States are assessed at the MFN rate.

What do the tariffs do?

Tariffs on imports are designed to raise the price of imported goods to discourage consumption. The intention is for citizens to buy local products instead, thereby stimulating their country's economy. Tariffs therefore provide an incentive to develop production and replace imports with domestic products.