Trump’s Tariffs on China Shake Global Markets

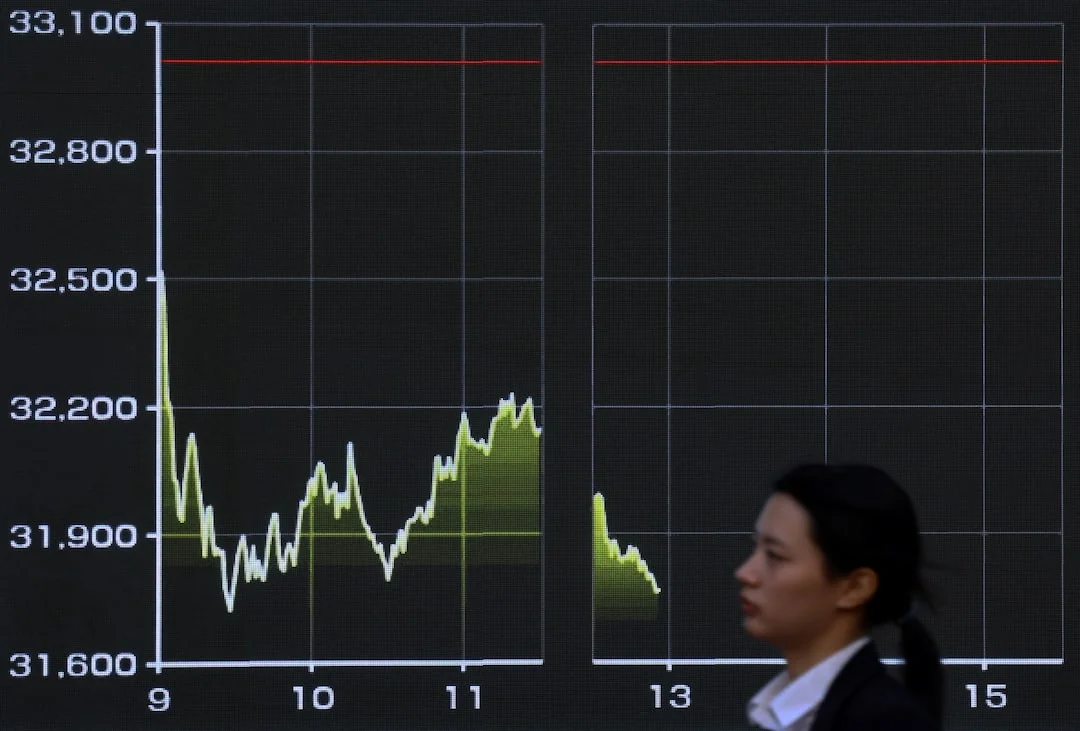

Former President Donald Trump's recent imposition of tariffs on Chinese goods has sent shockwaves through global financial markets. The move, aimed at reducing the U.S. trade deficit with China, has led to immediate reactions in stock markets worldwide. According to The New York Times, the announcement caused significant volatility, with investors scrambling to adjust their portfolios in anticipation of a potential trade war.

NPR reported that these tariffs are not only affecting the U.S. and China but also have implications for the European Union, as global trade dynamics shift. Bloomberg's live Q&A session highlighted the diverse reactions from market analysts, with some predicting a short-term dip in stock prices, while others foresee long-term benefits for domestic industries.

Politico's discussion with reporters emphasized the political motivations behind Trump's decision, suggesting it could be a strategic move to appeal to his voter base ahead of future elections. The ongoing debate over the effectiveness and consequences of these tariffs continues to dominate economic and political discourse, as stakeholders worldwide brace for the next developments in this unfolding trade saga.

Related issues news

Why does the stock market crash?

A stock market collapse typically occurs when the economy is overheated, inflation is rising, market speculation is rampant, and there is significant uncertainty about the path of an economy.

Why are stocks falling?

Stocks have fallen sharply since Trump unveiled sweeping tariffs late on Wednesday that investors worried could drive up inflation and push the global economy into recession. The Cboe Volatility index (. VIX) , opens new tab rose to 46.98, its highest close since April 2020.

What is a bear market in stocks?

A bear market is a Wall Street term for a sustained market downturn, when a stock index closes 20 percent from its last peak. The 20 percent threshold signals investor pessimism about the future of the economy.

Why did stocks rebound?

U.S. stocks roared back on Wednesday after days of steep losses after President Trump said he was pausing most tariffs for 90 days, except for those on Chinese goods. The Dow Jones Industrial Average soared nearly 3,000 points, or close to 8% as relief spread across investors.