Trump’s Tariffs Stir Global Economic Concerns

Former President Donald Trump's recent proposal to reinstate and expand tariffs has ignited a flurry of reactions from world leaders and economic analysts alike. According to reports from The Washington Post, Trump's tariff plan, which aims at bolstering American industries, has been met with skepticism and criticism internationally. Leaders from countries likely to be affected have expressed concerns over potential disruptions to global trade.

Economists featured in The Washington Post and The Guardian have labeled the tariffs as economically unsound, predicting a negative impact on both the U.S. and global economies. They argue that such measures could lead to retaliatory tariffs from other nations, escalating into a trade war that could dampen economic growth worldwide.

The New Yorker's analysis takes a more personal tone, suggesting that Trump's ego is a significant driver behind the tariff policy, potentially overshadowing rational economic considerations. This perspective adds a layer of complexity to the ongoing debate about the wisdom and impact of Trump's economic policies.

Detailed

Related issues news

How to calculate tariff on imports?

The big picture: Once you fight your way through the thicket of Greek letters, the formula is really very simple. The amount any country's tariff will rise is equal to our trade deficit with that country, divided by our total imports from that country — with a global floor of 10%.

Why impose tariffs?

Tariffs on imports are designed to raise the price of imported goods and services to discourage consumption. The intention is for citizens to buy local products instead, thereby stimulating their country's economy. Tariffs therefore provide an incentive to develop production and replace imports with domestic products.

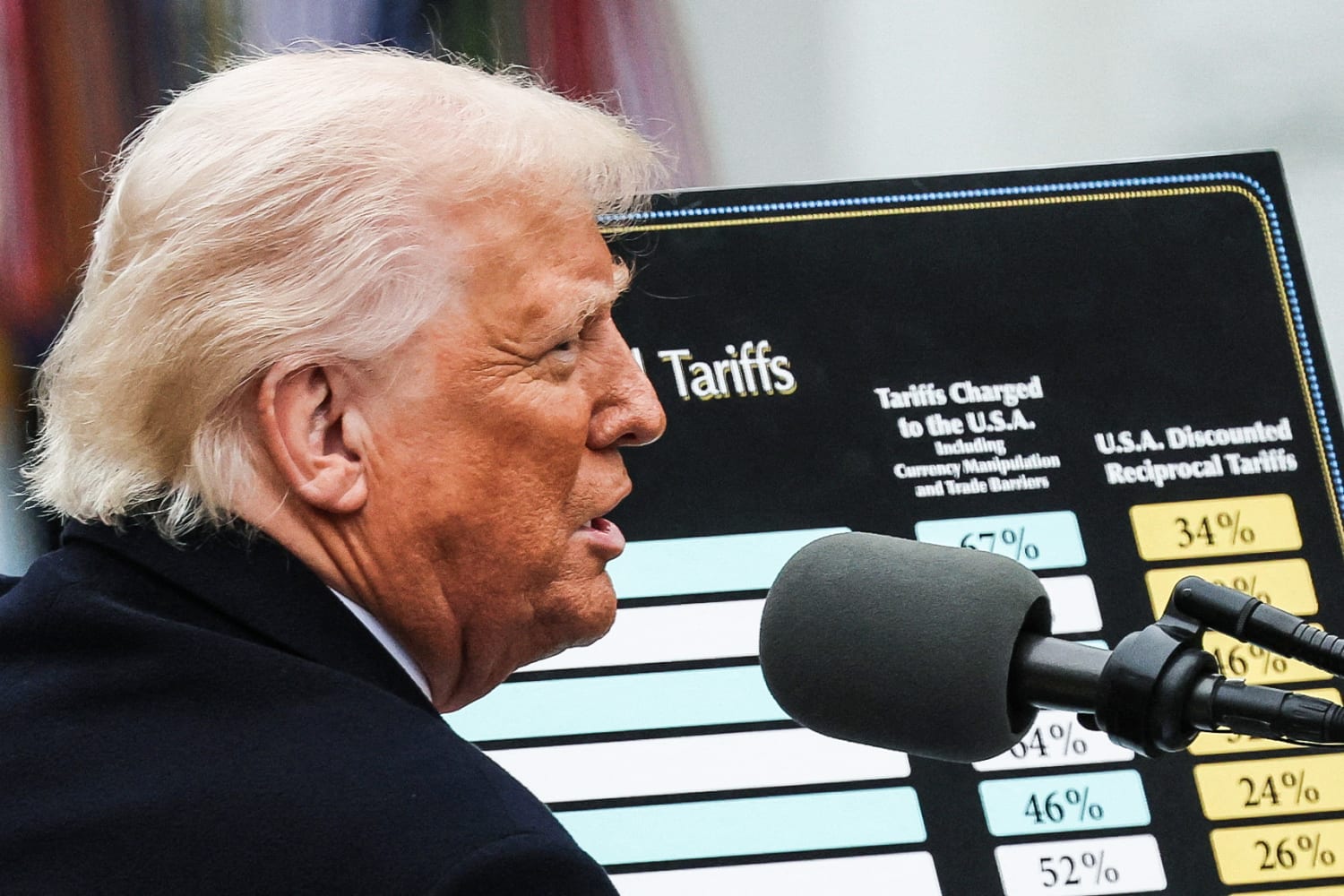

What are tariffs charged to the USA?

Tariffs are taxes on goods from other countries. Companies bringing the goods into the country pay the amount, typically a percentage of the goods' value, to the government. Trump announced a 10% 'baseline' tariff on imports to the US. This is what the UK will face.

How are tariffs collected?

Tariffs are taxes on imports, collected when foreign goods cross the U.S. border by the Customs and Border Protection agency. The money — about $80 billion last year — goes to the U.S. Treasury to help pay the federal government's expenses. Congress has authority to say how the money will be spent.