U.S. Treasury Bonds Sell-Off Amid New Tariffs

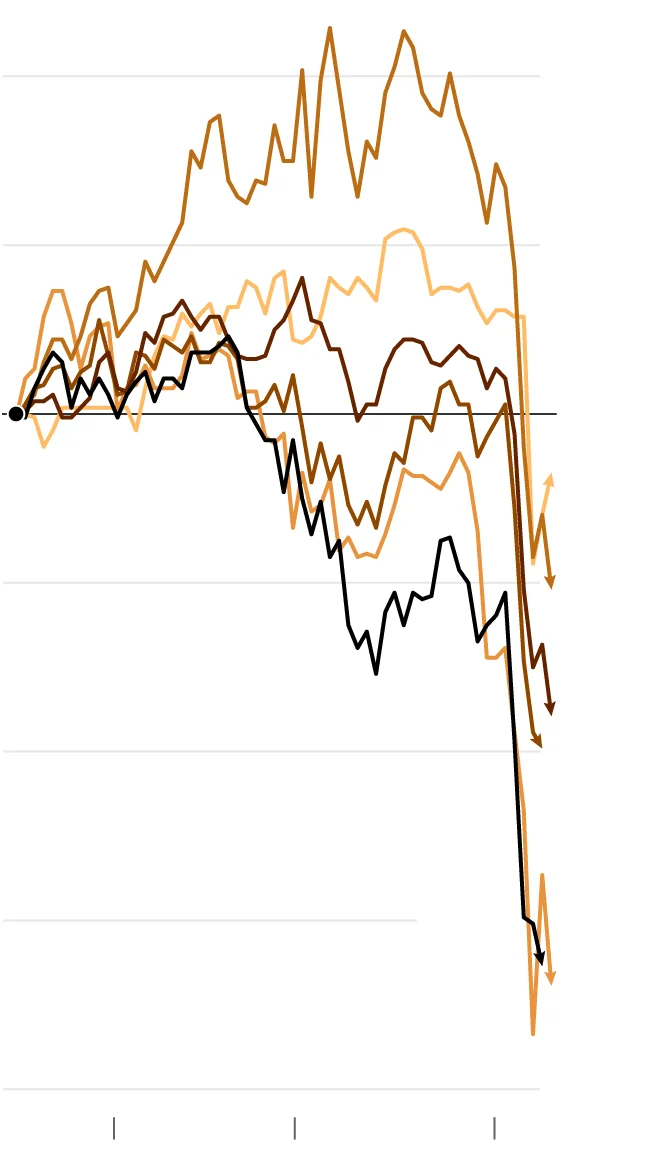

The U.S. financial markets are experiencing significant turbulence as investors react to the introduction of new reciprocal tariffs. According to reports from The New York Times and CNBC, these tariffs have led to a sharp sell-off in U.S. Treasury bonds, traditionally seen as a safe haven during economic uncertainty. The Wall Street Journal highlighted a broader market sentiment shift, describing it as a 'sell everything American' mode, which has further exacerbated the bond market's downturn.

Analysts from Barron's noted that the sell-off in Treasury bonds is a direct response to the new tariffs, which have introduced a level of unpredictability into the market. Investors are now reevaluating their portfolios, moving away from American assets in search of stability. This shift is not only affecting bond yields but also causing ripples across other sectors of the economy.

The situation underscores the interconnectedness of global trade policies and financial markets, with the new tariffs acting as a catalyst for widespread market adjustments. As the economic landscape continues to evolve, investors and policymakers alike will be closely monitoring the fallout from these developments.

Related issues news

Who buys government bonds?

Broker-dealers are the main buyers and sellers in the secondary market for bonds, and retail investors typically purchase bonds through them, either directly as a client or indirectly through mutual funds and exchange-traded funds.

What is the US bond market?

The bond market (also debt market or credit market) is a financial market in which participants can issue new debt, known as the primary market, or buy and sell debt securities, known as the secondary market.

What is 10 year yield?

Yield Open4.31% Yield Day High4.515% Yield Day Low4.308%

What is happening in the US bond market?

Thirty-year Treasury yields rose 20 bps to 4.92%. They have surged 53 bps over three days, their biggest three-day jump since 1982 . The selloff in long-dated bonds pushed the gap between two and 10-year yields to the widest since 2022.