Wall Street Swings Wildly As Trump’s Tariff Reversal Triggers Global Turmoil And Tough China Standoff

U.S. financial markets lurched into a new era of volatility Thursday, hot on the heels of President Trump's dramatic pivot on trade tariffs—a move that sparked the biggest one-day rally since World War II but quickly soured amid rising confrontations with China. This seismic shift in White House trade policy has sent tremors across Wall Street, shaken investor confidence, and reverberated worldwide, raising urgent questions about the future of U.S. economic leadership.

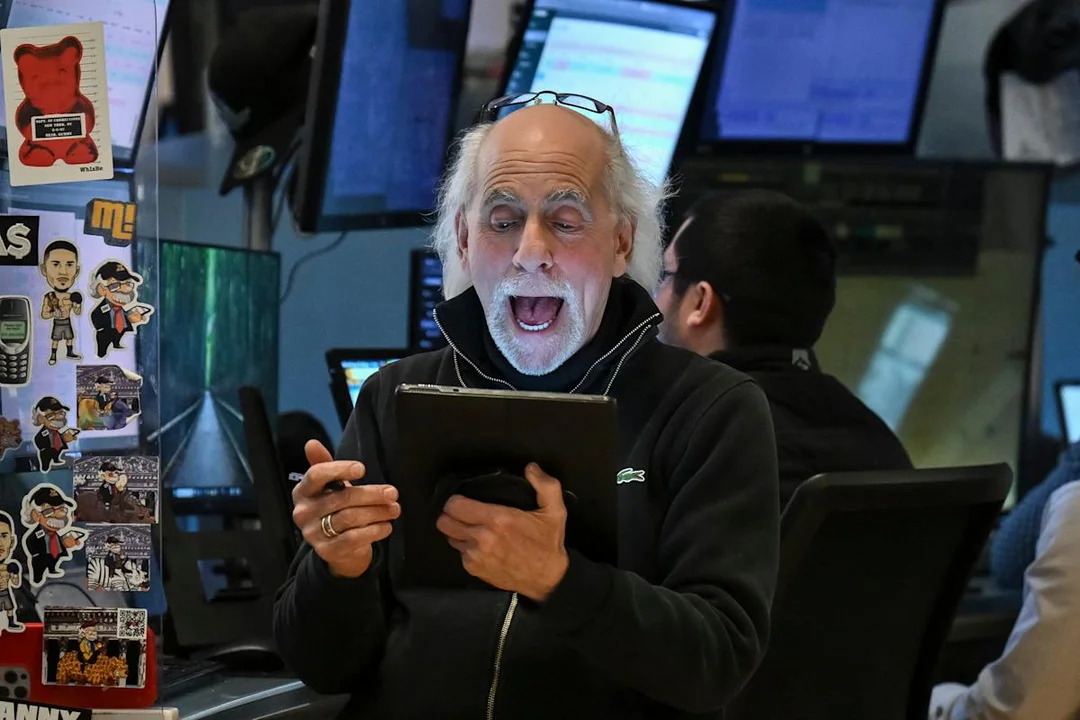

Wednesday’s “monster rally”—nearly 3,000 Dow points, a record—rewarded Trump’s surprise 90-day pause on steep tariff hikes for most allies. The S&P 500 soared nearly 10%, the Nasdaq over 12%, in their wildest single-session advances in years. Yet celebrations were short-lived. By Thursday morning, the euphoria had evaporated, replaced by Wall Street anxiety as Trump's aggressive escalation toward China took center stage, overshadowing hopes of calmer global trade.

The Dow cratered more than 900 points early Thursday, wiping out much of those historic gains. The S&P 500 declined over 2.8% while the Nasdaq plunged more than 3.4%. Big Tech’s “Magnificent Seven”—Nvidia, Tesla, Apple, Amazon, Meta, Microsoft, Alphabet—all saw sharp losses after adding $1.5 trillion in market value just a day earlier. Investors assessed a tit-for-tat tariff war spiraling further, instead of stabilizing, dragging down commodities, tech shares, and global confidence.

At the core: Trump’s sharp tariffs jump to 125% on Chinese goods—a retaliatory strike after Beijing hiked duties on U.S. imports to 84%. Commerce Secretary Howard Lutnick optimistically described the coming period as an “exploding” new “Golden Age,” but wary market watchers saw instead greater risks of disruption. Analysts at JP Morgan warned this was “merely the end of the beginning,” not a resolution, while Rabobank noted, “The trade war is now a direct confrontation… escalation and de-escalation happening at the same time.”

China’s Foreign Ministry lambasted America for wielding tariffs as a “weapon to exert maximum pressure… destabilizing global economic order,” announcing a further 50% penalty on all U.S. imports. Meanwhile, legendary investor Ray Dalio urged both sides to “reconsider their approaches,” warning of “better and worse ways to handle debt and imbalances.” Senator Bill Hagerty claimed this was a chance to “rectify” unfair Chinese trade but shared concerns of deepening divides.

Interestingly, Europe took a different path. Stocks there surged sharply Thursday, buoyed by the EU’s decision to match Trump’s tariff pause by suspending their own countermeasures for 90 days in hopes of negotiated resolution. Germany’s DAX jumped over 5.6%, France’s CAC by 5%, with London’s FTSE also rallying. European Commission chief Ursula von der Leyen stressed giving “negotiations a chance.” Asian markets initially rebounded too, but doubts about long-term calm remain widespread.

Adding complexity, new Consumer Price Index data from the U.S. suggested inflation cooled more sharply than forecast: just 0.1% monthly core rise in March, and 2.4% annually, below expectations. This offers some relief amid trade tumult but leaves questions about persistent underlying pressures. Oil prices dipped as well, facing fading demand prospects due to global growth worries, particularly as China is the largest crude importer.

Behind the headlines, fresh deals emerged: Trump boasted over $7 trillion in inbound private investments, led by Apple’s $500 billion commitment and Softbank-Oracle-OpenAI’s $500 billion Stargate AI datacenter plan, plus contributions from Taiwan Semiconductor and Nvidia. Apple reportedly chartered six giant cargo jets from India to speed iPhones stateside before tariffs fully bite. Yet U.S. Steel shares slid 10% after Trump opposed its planned takeover by Japan’s Nippon Steel, highlighting nationalist priorities complicating global mergers.

Ultimately, this volatile period reveals a global economy whipsawed by abrupt U.S. trade shifts, fierce China tensions, and unpredictable policy signals. Will Trump negotiate a lasting reset with Beijing or deepen economic divides? Can Wall Street regain its footing amid such crosswinds? Or is this whiplash the new normal? Readers—share your insights below: Are these moves bold negotiation tactics or dangerous brinkmanship? Let the debate begin.

Related issues news

What is the Dow Futures?

Dow Futures are financial futures which allow an investor to hedge with or speculate on the future value of various components of the Dow Jones Industrial Average market index. The futures instruments are derived from the Dow Jones Industrial Average as E-mini Dow Futures.

What is the impact of tariffs?

In a note to clients ahead of Wednesday's deadline, analysts with Wells Fargo said the tariffs would be likely to cause a “modest” stagflationary “shock” to the U.S. economy: As prices go up, they will contribute to eroding real income growth, causing spending and overall economic activity to contract, they said.