Wall Street’s Q1 Analysis: Market Dips and Economic Insights

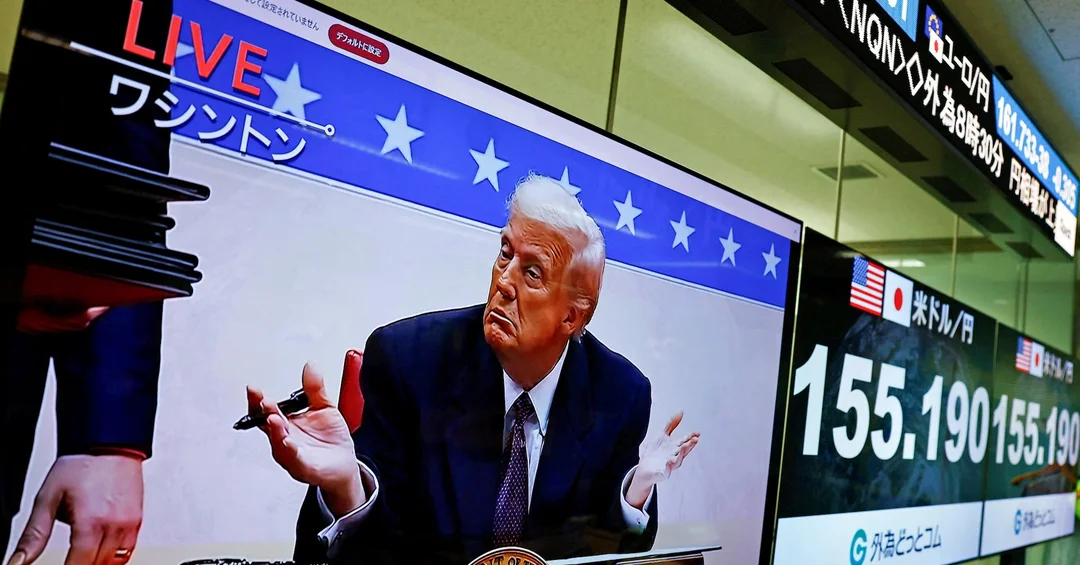

Wall Street's first quarter of 2025 has been marked by significant market fluctuations and a keen interest in buying the dips, according to multiple reports. Analysts from Reuters and Bloomberg have noted that investors are closely watching for the right moment to capitalize on these market movements. An insider's perspective from Politico sheds light on why the market has been particularly spooked this quarter, pointing to global economic uncertainties and domestic policy shifts.

The analysis reveals that the stock market in the U.S. experienced notable volatility, driven by a mix of international developments and domestic economic indicators. Despite these challenges, there is a consensus among Wall Street experts that the market's dips present buying opportunities. This strategic approach is seen as a way to navigate the unpredictable economic landscape effectively.

As the quarter closes, the focus remains on understanding these market trends and their implications for the broader economy. Investors and analysts alike are preparing for what could be a pivotal year in financial markets, with eyes set on both short-term gains and long-term stability.