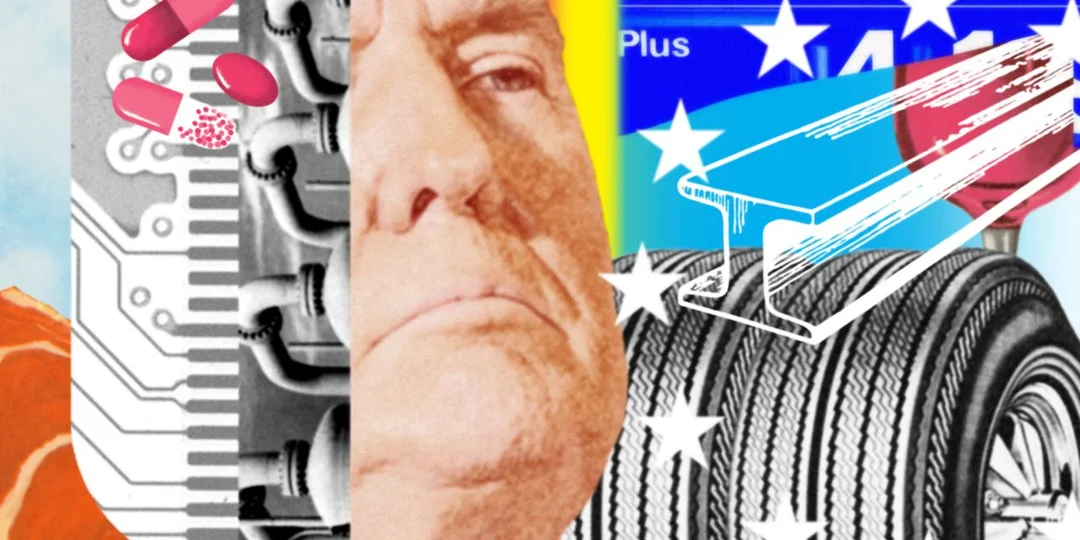

Why Your Next iPhone Could Cost Hundreds More: How Trump’s Tariffs Threaten America’s Tech Wallet

Technology lovers and casual consumers alike may soon face a financial gut punch as iPhones and other electronics get set to become significantly more expensive. The culprit? The Trump administration’s newly imposed sweeping tariffs on Chinese imports, a move that threatens to reshape global tech supply chains and hit American wallets in ways not seen before — and possibly very soon.

According to CNN Business, new tariffs targeting Chinese goods — now surging to a staggering 125% on certain tech items — could push iPhone prices up by hundreds of dollars. Analysts predict the flagship $1,199 iPhone 16 Pro Max assembled in China could balloon by as much as $675, a jaw-dropping 56% increase, while even India-sourced models might climb $120 more.

The shockwaves are already rippling through Apple’s supply chain discussions. With roughly 90% of iPhones built in China, the company faces immediate dilemmas on whether to absorb costs, pass them fully onto consumers, or rethink how and where it manufactures devices. Canalys analyst Jack Leathem bluntly assesses: Apple must endure a “period of pain,” likely leading to unavoidable price hikes.

Retail behavior is shifting swiftly too. As The Atlantic observes, panic-buying is underway in anticipation of price surges, with some stores resembling a “busy holiday season.” Americans are scrambling to buy devices before the tariff bite hits, underscoring just how central the smartphone has become in daily life — and how dependent it remains on delicate global trade dynamics.

President Trump’s stance is that such tariffs could revitalize American tech manufacturing, perhaps even bringing iPhone assembly lines stateside. But experts point out formidable obstacles: Bank of America estimates manufacturing in the US would cost 20% more, pushing iPhone prices as high as $3,500. Labor shortages, environmental challenges in sourcing rare materials domestically, and decades-old supply chain entanglements mean such change would be slow, costly, and complex.

Bank of America researchers also remind us that despite partial moves toward India or Vietnam, key components and rare earths are still largely sourced through China. IDC vice president Ryan Reith emphasizes, "Everything that’s inside still really comes through China. And that’s not going to change anytime soon." The Atlantic further outlines how parts originate worldwide: tantalum from the Congo, processors from Taiwan, rare earths refined by China, making the notion of an "All-American iPhone" nearly impossible — at least without drastically increasing prices.

Beyond the immediate sticker shock, these tariffs may prompt broader questions about consumer culture centered on rapid upgrade cycles fueled by tech giants. Will Americans still line up yearly for new devices if costs spike and global instability persists? Or might this be the moment consumers pause, repair older devices, and rethink constant tech consumption?

While Apple has yet to comment on tariff strategies, some speculate it could stagger release schedules or push installment plans more aggressively. Wireless carriers, meanwhile, are expected to promote older models with discounts to offload untaxed inventory.

As the trade standoff drags on, one thing is certain: these tariffs won’t just be an economic chess match between superpowers. They will be felt in everyday American lives — perhaps as soon as the next trip to your neighborhood Apple Store when that hotly anticipated upgrade suddenly seems far less affordable.

Will skyrocketing smartphone prices finally slow America’s insatiable gadget habit? Or will it ignite calls to rethink global tech dependence altogether? Join the conversation by leaving your thoughts below — what’s your take on Trump’s tariff push and your next upgrade?

Related issues news

How much to make an iPhone in the USA?

If Apple were to begin assembling iPhones in the U.S, a Chinese-made device that previously sold for $1,000 would cost $3,500 if manufactured in New Jersey, Texas or some other state, Ives estimated.

How is Apple impacted by tariffs?

Most iPhones are still made in China, which was hit with a 54% tariff. If those levies persist, Apple (AAPL.O) , opens new tab has a tough choice: absorb the extra expense or pass it on to customers. Shares of the company closed down 9.3% on Thursday, hitting their worst day since March 2020.

When will tariffs affect iPhones?

Along with many peers, Apple has been stocking up on inventory stateside for months in anticipation of the tariffs. Units already on US land aren't subject to the levies. That means Apple theoretically could hold off until the next iPhones in September to make adjustments, if it ultimately does so.

Where is the Apple iPhone made?

About 90% of iPhones are assembled in China.